List of Funded Series E Startups (2025)

Series E Startups are playing to win at global scale.

By Series E, startups are no longer proving themselves. They’re preparing for IPOs, strategic acquisitions, or aggressive global domination.

At Fundraise Insider, we track every newly funded Series E startup in the US and deliver verified contact details for the founders, C-suite, and senior decision makers driving their next phase – the best sales prospecting leads.

With $100+ million in recent funding, these companies are investing heavily in growth infrastructure: from expanding leadership teams and entering new regions to overhauling tech stacks, scaling operations, and securing enterprise partnerships.

List of Funded Series E Startups

👉 Get weekly leads from newly funded Series E startups ready to buy.

Selling to Series E Startups

1. What kind of growth are Series E startups usually pursuing?

Series E startups are typically focused on global expansion, acquisitions, preparing for public offering, or launching new product lines. They are aggressively investing in performance, compliance, and enterprise readiness.

2. How do Series E companies evaluate new service providers?

They prioritize vendors who can operate at enterprise scale, offer proven results, and meet strict security and regulatory standards. They value case studies, industry experience, and evidence of delivering for similar sized companies.

3. What is the budget structure like at this funding stage?

Budgets are large but tightly controlled. Department leaders often have spending authority, but purchases over a certain amount may require procurement or executive sign off. Clear value and low friction onboarding speed up approvals.

4. What departments are most open to external vendors?

Operations, customer success, international marketing, IT infrastructure, and finance transformation teams are actively sourcing partners. Many are tasked with implementing systems that support global scale or reduce cost per unit.

5. Is there a best time to approach a Series E startup?

The 2 to 4 weeks after funding is announced are ideal. Teams are setting aggressive targets and evaluating vendors during this period. This window is critical for building early relationships and getting into the buying process.

6. What are the most common pain points for Series E startups?

Frequent challenges include fragmented systems, global compliance gaps, scaling hiring processes, maintaining service quality, and cost control. If your offering supports any of these, you have a strong entry point for outreach.

7. Should I tailor my outreach by vertical or function?

Yes. A vertical specific pitch shows you understand the company’s customers and compliance environment. Function based messaging speaks directly to the problems of the role you are targeting. Combining both works best.

8. What makes Series E startups different from Series C or D?

By Series E, companies are operating at greater complexity. They have larger teams, multiple product lines, and often international markets. They are more risk averse and prefer to work with vendors who bring experience and scale.

9. How technical does my offering need to be?

It depends on the buyer. While technical depth is important, business impact is just as critical. Focus on integration, performance improvement, and measurable outcomes. Speak the language of revenue, security, and efficiency.

10. Where can I find contact information for Series E startups?

Fundraise Insider delivers weekly sales leads of recently funded Series E startups, including names, job titles, verified email addresses, funding amounts, and location filters for focused outreach.

Other Funded Startups Data

- Pre-Seed startups

- Seed startups

- Series A startups

- Series B startups

- Series C startups

- Series D startups

- Series F startups

- Series G startups

- AI first startups

- Recently funded startups across all funding stages

Series E Startup Funding: Statistics and Trends Data

Total Series E Startup Funding Rounds and Timeline

- 11 financings from January 8 to April 9, 2025.

Series E Startup Funding Checks

- Mean: $437.4 M | Median: $111 M

- Interquartile Range: $74.5 M (25th) to $225 M (75th)

- Range: $40 M to $3.5 B

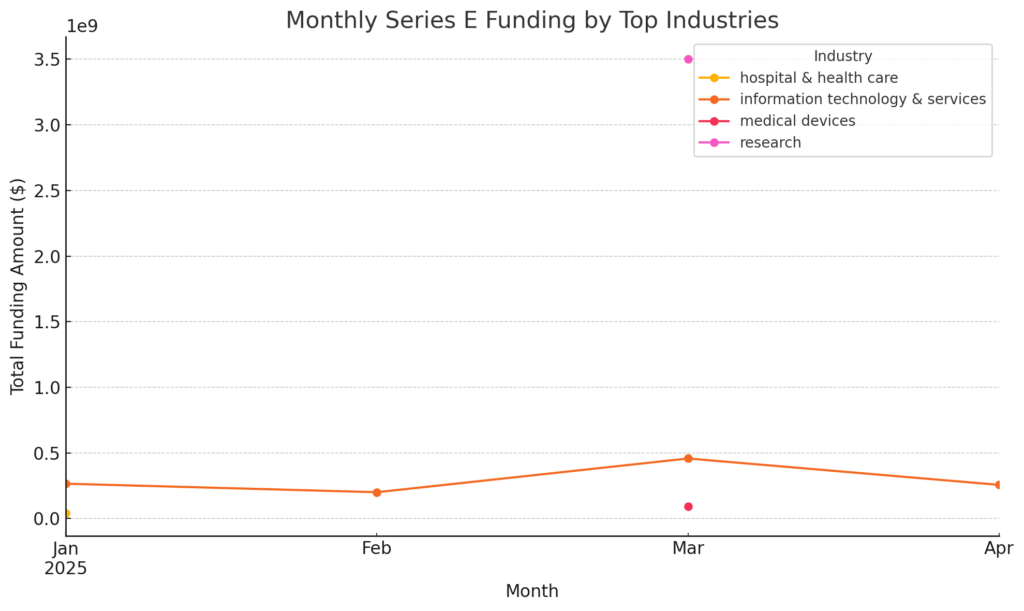

Monthly Series E Startup Funding Activity

- January: 2 rounds, $305 M total

- February: 1 round, $200 M

- March: 6 rounds, $4.65 B (dominated by a $3.5 B research raise)

- April (to 4/9): 2 rounds, $0.26 B

Top Industries by Series E Startup Funding Volume and Capital

By Series E Startup Funding Round Count:

- Information Technology & Services (7 rounds)

- Medical Devices (2)

- Hospital & Health Care (1)

- Research (1)

By Total Series E Startup Funding:

- Research: $3.5 B (single outlier)

- Information Technology & Services: $1.178 B

- Medical Devices: $93 M

- Hospital & Health Care: $40 M

Geographic Concentration of Series E Startup Funding Rounds

- By Deal Count: California (6), Arizona (1), Michigan (1), New York (1), Texas (1)

- By Capital Deployed: California ($4.332 B), Texas ($0.25 B), New York ($0.096 B), Washington ($0.053 B), Arizona ($0.04 B)

Outlier Note

- A $3.5 B research-round in March skews the monthly and industry sums; without it, March Series E funding drops to $1.15 B.

Series E Startup Funding: Growth Curves Across Top Industries Compared

- Information Technology & Services (dark orange) maintains a steady mid-range presence, dipping slightly in February before peaking in March ($450 M) and tapering in April ($275 M).

- Research (pink) is dominated by one massive $3.5 B raise in March, unmatched by any other sector or month.

- Medical Devices (red) appears only in March with a $93 M round indicating a single mid-quarter instance.

- Hospital & Health Care (gold) shows only a January raise of $40 M, an isolated early-quarter event.

Key Takeaways:

- Steady Drivers: IT & Services offers consistent deal flow across the quarter.

- Blockbuster Moments: Research delivers one-off, high-impact capital mid quarter, requiring precise timing.

- Niche Signals: Medical Devices and Healthcare have sparse, singular spikes, ideal for targeted outreach around those events.

Exceptionally Large and Small Series E Startup Funding Rounds

Exceptionally Large Series E Startup Funding Round (> $450.75 M)

- Anthropic: $3.5 B on March 3, 2025 (research).

Exceptionally Small Series E Startup Funding Rounds (≤ $40 M, 5th percentile threshold)

- Shoulder Innovations: $40 M on March 10, 2025 (medical devices)

- Solera Health: $40 M on January 14, 2025 (hospital & health care)

Strategic Takeaways For Series E Startup Funding

Average Series E Startup Funding Deal Size by Industry

- Research: $3.50 B (single round)

- Information Technology & Services: $168.3 M (7 rounds)

- Medical Devices: $46.5 M (2 rounds)

- Hospital & Health Care: $40 M (1 round)

Average Series E Startup Funding Deal Size by State

- California: $722 M (6 rounds)

- Texas: $250 M (1 round)

- New York: $96 M (1 round)

- Washington: $53 M (1 round)

- Arizona & Michigan: $40 M each (1 round each)

Industry-State Clusters For Series E Startup Funding Rounds

Research:

- California: 1 round @ $3.5 B

Information Technology & Services:

- California: 5 rounds @ $166.4 M avg

- Texas: 1 @ $250 M

- New York: 1 @ $96 M

Medical Devices:

- Washington: 1 @ $53 M

- Michigan: 1 @ $40 M

Hospital & Health Care:

- Arizona: 1 @ $40 M

Strategic Takeaways:

- Blockbuster vs. Bread-and-Butter: The lone Research raise in California dwarfs all others; IT & Services provides the bulk of deal flow at mid range ticket sizes.

- Volume Hotspot: California dominates both across and within industries, ideal for concentrated Series E sourcing.

- Targeted Plays: Medical Devices and Healthcare Series E are one off state level events in Washington, Michigan, and Arizona, opportunistic rather than volume.

- Diversification: To balance a portfolio, mix consistent IT & Services deals in CA with occasional high impact Research rounds, while selectively exploring medical device outliers in niche states.