List of Funded Series D Startups (2026)

Series D Startups are in hyper scale mode and they’re not slowing down.

These are late stage companies with proven traction, serious revenue, and massive rounds often exceeding $100 million. They’re entering new markets, acquiring competitors, expanding internationally, and preparing for IPO or major exits.

At Fundraise Insider, we track every newly funded Series D startup across the US and deliver verified contact info for the founders, C-suite, and key department heads behind their next phase of growth – the best sales prospecting leads.

At this stage, they’re building enterprise operations, hiring senior leaders, consolidating platforms, and partnering with vendors who can support global scale and complexity.

Below is a free sample of recently funded Series D companies. While 99% of sales professionals are still grinding through LinkedIn hoping for a 0.7% response rate, you can unlock the holy grail of B2B prospecting: companies with actual money ready to spend.

That’s what Fundraise Insider gives you. Not just data, but timing. Not just a list, but an edge.

Sign-up here for the #1 sales prospecting and lead generation tool. And remember, this isn’t a monthly subscription. You pay once to receive a lifetime access to weekly leads.

Newly Funded Series D Startups

Click here to download 10 leads from newly funded startups.

Leads list includes: First Name, Last Name, Title, Company, Email, Linkedin Url, # Employees, Industry, Website, Company Linkedin Url, Facebook Url, Twitter Url, Company Phone, Technologies, Annual Revenue, Short Description, Founded Year, Top 5 Investors, Funding Amount, Headquarters, Funding Type, Funding Date

How to Sell to Series D Startups

1. What strategic goals are common for Series D companies?

Series D startups are often focused on aggressive expansion, product diversification, entering international markets, or getting ready for acquisition or public offering. They are looking for partners who can support scale and stability.

2. How can I get the attention of a Series D company?

Start with a highly personalized email that speaks to their current growth stage and includes a clear result you delivered for a company of similar size. Referencing recent news or investor activity can increase relevance.

3. What kind of support services do they outsource most often?

Series D startups often outsource specialized needs like enterprise technology implementation, high volume recruitment, localization services, advanced data analytics, and operational compliance programs.

4. Are Series D companies more likely to have procurement processes?

Yes. At this stage, formal procurement is common. Most purchases require approval from both the budget holder and compliance or legal teams. Having case studies, references, and a smooth procurement experience helps a lot.

5. How important is speed of execution when working with Series D clients?

Very important. These companies are under pressure to show returns on capital. They value vendors who can start quickly, deliver fast wins, and adapt as needs evolve. Time to value is often a key decision factor.

6. What makes outreach more effective at this funding stage?

Use business metrics in your outreach. Mention KPIs like revenue acceleration, churn reduction, or conversion lift. The more you tie your value to financial or operational goals, the higher the response rate will be.

7. What concerns do Series D decision makers have when selecting vendors?

They are concerned about security, vendor reliability, ability to handle scale, and ROI. Messaging that addresses risk mitigation, integration ease, and long term impact tends to resonate most with leadership teams.

8. How much competition is there for selling into Series D startups?

It is high. These companies attract a lot of attention because they have funding and momentum. Standing out requires specificity, social proof, and a very clear match between what you offer and their current needs.

9. What is the role of the founder at this stage in buying decisions?

Founders are still influential, especially for major vendor relationships. However, department heads and senior leadership usually lead vendor evaluation. You may need to build support across multiple stakeholders.

10. Where can I find a list of Series D startups that recently raised capital?

Fundraise Insider provides curated weekly sales leads list of Series D startups with verified decision maker contacts, funding data, and company size so you can reach out early and sell with confidence.

Other Funded Startups Data

- Pre-Seed startups

- Seed startups

- Series A startups

- Series B startups

- Series C startups

- Series E startups

- Series F startups

- Series G startups

- Hottest AI startups in Silicon Valley

- Recently funded startups across all funding stages

Series D Startup Funding: Statistics and Trends Data

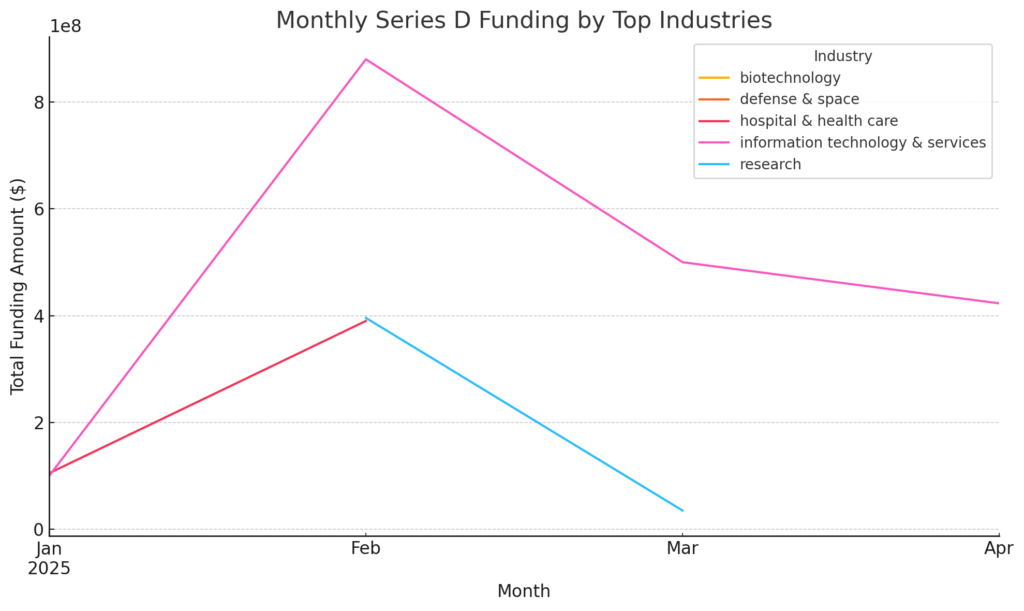

These insights map the mid-late-stage funding landscape, spotlighting the dominance of IT Services in California and the pacing of Series D deployments across the quarter.

Total Series D Startup Funding Rounds and Timeline

- 22 financings from January 13 to April 16, 2025.

Series D Startup Funding Checks

- Mean: $158.4 M | Median: $102.5 M

- Interquartile Range: $46.25 M (25th) to $250 M (75th)

- Range: $0 (1 undisclosed) to $480 M

Monthly Series D Startup Funding Trends

- January: 3 rounds, $235 M total

- February: 8 rounds, $1.173 B

- March: 8 rounds, $2.114 B

- April (to 4/16): 3 rounds, $0.475 B

Top Industries by Series D Funding Round Count

- Information Technology and Services: 12 rounds

- Hospital and Health Care: 3

- Research: 2

- Defense and Space: 2

- Biotechnology: 1

Top Industries by Series D Total Capital

- Information Technology and Services: $1.903 B

- Hospital and Health Care: $0.495 B

- Research: $0.431 B

- Defense and Space: $0.250 B

- Biotechnology: $0.205 B

Geographic Concentration of Series D Startup Funding Rounds

- By Deal Count: California (14), New York (3), Pennsylvania (2), Alabama (1), Massachusetts (1)

- By Deployed Capital: California ($1.976 B), New York ($0.523 B), Alabama ($0.450 B), Pennsylvania ($0.300 B), Minnesota ($0.175 B)

Series D Startup Funding: Growth Curves Across Top Industries Compared

- Information Technology and Services (pink) surged from $100 M in January to $900 M in February, then gradually declined to $420 M by April, highlighting a strong early quarter peak.

- Hospital and Health Care (red) rose steadily from $110 M to $390 M in February before tapering to $180 M by April, a smooth “hill” pattern.

- Research (blue) spiked to $400 M in February then fell off sharply, with no March/April activity, indicating a one off boost.

- Defense and Space (orange) and Biotechnology (gold) both had modest activity concentrated in two to three months, peaking at $60 M and $50 M, respectively.

Key Takeaways:

- Early Surge Sectors: IT Services and Hospital and Health Care are most active early in the quarter.

- Short-Lived Peaks: Research offers big but quick opportunities; timing is critical.

- Consistent Mid-Range Deals: Defense and Space and Biotechnology deliver smaller, steadier capital flows.

Exceptionally Large and Small Series D Startup Funding Rounds

Exceptionally Small Series D Startup Funding Rounds (≤ $30 M, 5th percentile threshold)

- Vouch: $25 M on 2025-02-13

- Clear Labs: $30 M on 2025-01-13

No Exceptionally Large Series D Outliers

- Using an IQR-based upper threshold of $555.6 M, there are no rounds exceeding this amount.

Strategic Takeaways For Series D Startups Funded

Average Series D Startups Deal Size by Industry

- Defense and Space: $250 M

- Information Technology and Services: $211.4 M

- Hospital and Health Care: $165 M

- Research: $143.6 M

- Biotechnology: $102.5 M

Average Series D Startups Funding Deal Size by State

- Alabama: $450 M (driven by a single large round)

- Minnesota: $175 M

- New York: $174.3 M

- Pennsylvania: $150 M

- California: $141.1 M

Industry-State Clusters for Series D Startup Funding

Information Technology and Services:

- California: 6 rounds @ $182.5 M avg

- New York: 1 round @ $308 M

- Alabama: 1 round @ $450 M

Hospital and Health Care:

- Pennsylvania: 1 round @ $250 M

- New York: 1 @ $140 M

- California: 1 @ $105 M

Research:

- California: 3 rounds @ $143.6 M avg

Defense and Space:

- California: 1 @ $250 M

Biotechnology:

- Minnesota: 1 @ $175 M

- California: 1 @ $30 M

Strategic Takeaways:

- High-Value Niches: Defense & Space and IT & Services in markets like Alabama and New York show outsized check sizes.

- Volume Hubs: California drives the most Series D activity across multiple sectors with solid mid-range averages.

- Selective Markets: States like Minnesota and Pennsylvania offer niche biotech and healthcare rounds with above average checks.