List of Recently Funded Series C Startups (2025)

List of Funded Series C Startups

👉 Get weekly leads from newly funded Series C startups

Weekly leads list includes: First Name, Last Name, Title, Company, Email, Linkedin Url, # Employees, Industry, Website, Company Linkedin Url, Facebook Url, Twitter Url, Company Phone, Technologies, Annual Revenue, Short Description, Founded Year, Top 5 Investors, Funding Amount, Headquarters, Funding Type, Funding Date.

Selling to Series C Startups

1. What stage of growth are Series C startups typically in?

Series C startups have usually proven their product market fit, built strong revenue traction, and are expanding into new geographies or verticals. They often focus on scaling infrastructure, operations, and market dominance.

2. What type of services are they actively sourcing?

Common needs include performance marketing, customer success optimization, enterprise software, hiring solutions, revenue operations, and security compliance services. They prioritize vendors who can scale with them.

3. How large are the teams at Series C startups?

Team sizes typically range from 100 to 500 employees, depending on the sector and growth rate. This creates opportunities for external vendors to assist with automation, training, and operational efficiency.

4. What role do investors play in vendor decisions at this stage?

Investors may influence decisions indirectly by setting goals tied to growth or profitability. Founders and department heads still lead vendor selection, but they often prefer partners who understand metrics like LTV, CAC, and ARR.

5. Do Series C startups work with new vendors or stick with existing ones?

While many relationships are already in place, Series C startups are always testing better solutions. If your offer helps them accelerate revenue, reduce churn, or scale efficiently, they will take a meeting.

6. How technical should my outreach be?

Tailor your messaging based on the role. A CTO may prefer deeper technical insights, while a Head of Operations may value cost savings or time to deployment. Know your audience before crafting your message.

7. What decision making process do these companies follow?

There is usually a structured evaluation involving the budget owner, end user team, and procurement. Providing clarity on implementation timelines, case studies, and integration details helps speed up approvals.

8. What pain points do Series C companies experience most?

Growing pains often include scaling sales teams, onboarding large volumes of customers, maintaining product quality across regions, and managing data security at scale. Vendors that address any of these are in demand.

9. Should I pitch cost efficiency or revenue growth?

Both can work. For Series C companies, efficiency and scalability are as important as growth. Frame your pitch around tangible results, either saving time and money or generating more revenue faster.

10. Where can I get a verified list of recently funded Series C startups?

Fundraise Insider provides weekly sales leads that include recently funded Series C startups, along with decision maker contact info and funding details to help you reach the right people at the right time.

Other Funded Startups Data

- Pre-Seed startups

- Seed startups

- Series A startups

- Series B startups

- Series D startups

- Series E startups

- Series F startups

- Series G startups

- AI startups

- Recently funded startups across all funding stages

Series C Startup Funding: Statistics and Trends Data

Total Series C Startup Funding Rounds and Timeline

47 financings between January 7, 2025 and April 16, 2025.

Statistics of Series C Startups Funding Amounts

-

Mean: $119.2 M, Median: $80 M

-

25th–75th percentile range: $50 M–$144 M

-

Maximum: $600 M

Monthly Series C Startup Funding Trends

-

January: 12 rounds, $1.246 B total

-

February: 12 rounds, $1.833 B total

-

March: 17 rounds, $3.106 B total

-

April (to 4/16): 6 rounds, $0.729 B total

Top Industries by Series C Startup Funding Activity

-

Series C Startup Funding By Round Count:

-

Information Technology & Services (15 rounds)

-

Research (8)

-

Defense & Space (6)

-

Financial Services (5)

-

Semiconductors (4)

-

-

Series C Startup Funding By Total Capital:

-

Information Technology & Services ($2.213 B)

-

Research ($1.191 B)

-

Defense & Space ($0.776 B)

-

Financial Services ($0.463 B)

-

Semiconductors ($0.250 B)

-

Geographic Concentration of Series C Stage Startup Funding Rounds

-

By Deal Count: California (19), Massachusetts (5), New York (5), Texas (4), Illinois (3)

-

By Capital Deployed: California ($2.099 B), Texas ($1.335 B), Massachusetts ($0.648 B), Illinois ($0.560 B), New York ($0.220 B)

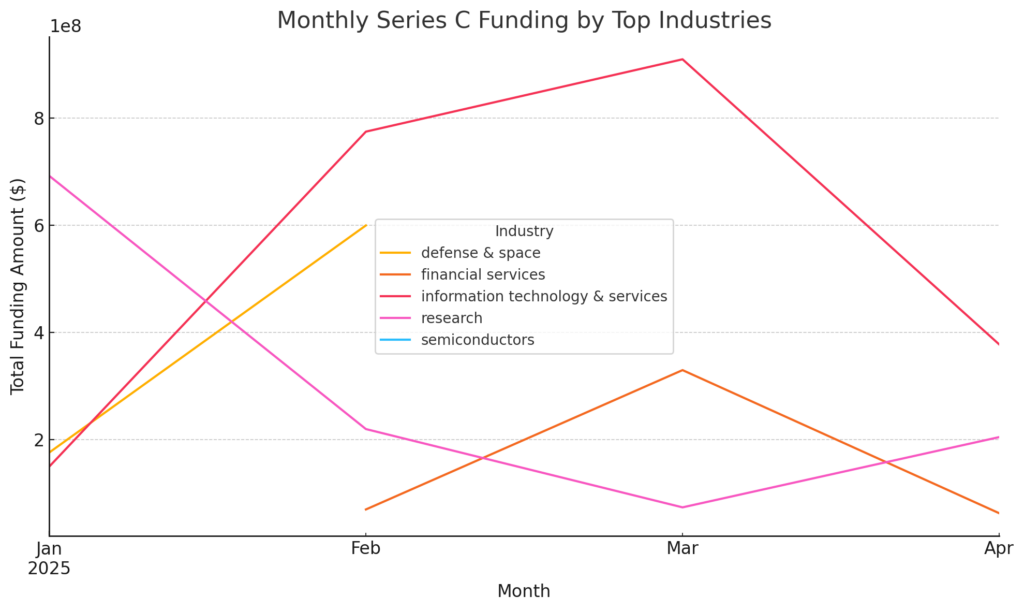

Series C Startup Funding: Growth Curves Across Top Industries Compared

The curves highlight distinct funding dynamics for top Series C startup industries:

-

Information Technology and Services (red) steadily accelerated from $150 M in January to $920 M in March, before dipping to $380 M in April showing mid-quarter peaks.

-

Defense and Space (gold) spiked sharply to $600 M in February, then declined to below $10 M by April, indicating a short-lived surge.

-

Financial Services (orange) climbed from $70 M in January to $330 M in March, then receded to $60 M in April, an upside-down “V” pattern.

-

Research (pink) trended downward from $700 M in January to $80 M in March, with a modest April rebound to $210 M, suggesting front-loaded deals.

-

Semiconductors (blue) appeared only in March with a one-off blockbuster raise of $1.45 B, underscoring highly lumpy capital deployment.

Strategic Insight:

-

Mid-Quarter Windows: IT Services and Financial Services peak in the middle of the quarter – prime sourcing opportunities.

-

Tactical Plays: Defense and Space and semiconductors require exceptionally precise timing around their singular spikes.

-

Front-Loaded Opportunities: Research deals occur early; engage at quarter start for a consistent pipeline.

Exceptionally Large and Small Series C Startup Funding Rounds

Exceptionally Large Series C Startups Funded (> $285 M)

-

Saronic: $600 M on 2025-02-18

-

Nerdio: $500 M on 2025-03-18

-

NinjaOne: $500 M on 2025-02-24

-

Mercury: $300 M on 2025-03-26

Exceptionally Small Series C Startups Funded (≤ $20 M)

-

Lineus Medical: $4.579 M on 2025-03-04

-

Phase Four: $6.25 M on 2025-01-09

-

Enveda Biosciences: $20 M on 2025-02-27

-

Parsyl: $20 M on 2025-01-08

Strategic Takeaways For Series C Startups Funded

Average Series C Startup Deal Size by Industry

-

Industries like Semiconductors and Electrical/Electronic Manufacturing top the list for per-round check sizes, followed by Defense & Space and Research.

-

More volume-driven categories—Information Technology & Services—land in the mid-range.

Average Series C Startup Deal Size by State

-

North Carolina and Texas show among the highest average Series C rounds, alongside California and Massachusetts.

-

Some smaller states (e.g., Delaware) can also deliver outsized checks.

Industry–State Clusters for Series C Startups Funded

-

Information Technology and Services:

-

California (9 rounds @ $100.6 M avg)

-

Ontario and Oregon each with a single round above $80 M

-

-

Research:

-

Massachusetts (3 rounds @ $160.5 M avg)

-

California (3 rounds @ $95 M avg)

-

Strategic Takeaways:

-

High-Value Bets: Target niche industries (Semiconductors, Defense and Space, Research) in states like North Carolina and Massachusetts for above-average Series C checks.

-

Volume Plays: For a steady deal flow, focus on Information Technology and Services in California.

-

Underserved Geographies: Keep an eye on emerging markets like Ontario or Oregon for potential outlier rounds.