List of Funded Series B Startups (2025-2026)

Series B startups are built to scale and fresh funding is fueling their acceleration.

By the time they reach Series B, these companies have already proven traction in the market. With tens of millions in new capital, they’re focused on rapid expansion, hiring bigger teams, entering new markets, and investing heavily in sales, marketing, and technology to outpace competitors.

At Fundraise Insider, we track every newly funded Series B startup and provide verified contact details for their founders, executives, and decision-makers so you can connect right when they’re making large-scale buying decisions.

Below is a preview of recently funded Series B startups driving serious growth.

While 99% of sales professionals are still grinding through LinkedIn hoping for a 0.7% response rate, you can unlock the holy grail of B2B prospecting: companies with actual money ready to spend.

That’s what Fundraise Insider gives you. Not just data, but timing. Not just a list, but an edge.

Sign-up here for the #1 sales prospecting and lead generation tool. And remember, this isn’t a monthly subscription. You pay once to receive a lifetime access to weekly leads.

List of Funded Series B Startups

Click here to download 10 leads from newly funded startups.

Series B startups leads list includes: First Name, Last Name, Title, Company, Email, Linkedin Url, # Employees, Industry, Website, Company Linkedin Url, Facebook Url, Twitter Url, Company Phone, Technologies, Annual Revenue, Short Description, Founded Year, Top 5 Investors, Funding Amount, Headquarters, Funding Type, Funding Date.

FAQs: Selling to Series B Startups

1. What defines a Series B startup compared to earlier stages?

Series B startups have proven product market fit, established revenue streams, and are raising capital to accelerate user growth, scale infrastructure, and enter new markets. They often grow from dozens to hundreds of employees in a short time.

2. Why are Series B companies actively buying services?

They are under pressure to deliver results with newly raised capital. This leads to immediate investments in marketing, sales enablement, technology upgrades, and talent acquisition to support expansion goals.

3. What are the signs that a Series B company is a good sales target?

Watch for companies hiring rapidly, launching new products, or entering international markets. These are strong indicators that they need support with scaling systems, reaching new audiences, or improving internal processes.

4. What types of vendors are most in demand at Series B?

Startups at this stage look for vendors who specialize in growth strategy, customer acquisition, sales training, backend architecture, data infrastructure, and employee experience platforms.

5. What role does urgency play when selling to Series B startups?

Urgency is high. Series B startups are expected to hit aggressive milestones quickly. They want partners who understand startup velocity and can execute with minimal hand holding or delay.

6. Do Series B companies work with early stage service providers?

Yes, if those providers show clear expertise, fast implementation ability, and a lean pricing model. Shared startup DNA and flexibility can be major advantages during the vendor evaluation process.

7. What is the best outreach strategy for Series B leads?

Keep your outreach short, specific, and aligned to a clear business objective like lowering churn or boosting conversion. Share examples of past results and be ready to offer a quick diagnostic or pilot proposal.

8. What objections should I be ready to overcome?

Common concerns include vendor reliability, integration time, internal bandwidth, and short term ROI. Providing proof of outcomes, customer references, and frictionless onboarding options helps reduce resistance.

9. How long does the sales cycle usually take?

It can range from 2 to 6 weeks depending on the deal size, urgency of need, and involvement of multiple stakeholders. Offering quick wins can accelerate timelines and build trust for larger projects.

10. Where can I find verified Series B startup leads?

Fundraise Insider provides weekly updated leads lists of Series B funded startups, complete with C-level contact details, funding size, location, and sector insights to support your outreach strategy.

Other Funded Startups Data

- Pre-Seed startups

- Seed startups

- Series A startups

- Series C startups

- Series D startups

- Series E startups

- Series F startups

- Series G startups

- AI startups

- Recently funded startups across all funding stages

Series B Startup Funding Statistics and Trends

Total Series B Startup Rounds and Timing

-

115 financings from January 6, 2025 through April 18, 2025 (22 rounds in April, 29 in March, 39 in February, 25 in January).

Descriptive Statistics of Series B Startup Funding Checks

-

Average deal: $182.4 M; median: $38 M; IQR: $25 M–$67.75 M.

-

Range spans $0 (4 undisclosed rounds) up to a $14.5 B mega-raise.

Monthly Series B Funding Volume and Capital Deployed

-

January: 25 rounds, $1.083 B total

-

February: 39 rounds, $2.886 B

-

March: 29 rounds, $15.8697 B (spike from mega-rounds)

-

April: 22 rounds (to 4/18), $1.135 B

Top Industries by Series B Funding Round Count

-

Information Technology & Services (48 rounds)

-

Research (10)

-

Environmental Services (5)

-

Hospital & Health Care (4)

-

Computer & Network Security (4)

Top Industries by Total Series B Capital

-

Semiconductors: $14.614 B (few blockbuster raises)

-

Information Technology & Services: $3.063 B

-

Research: $0.835 B

-

Environmental Services: $0.313 B

-

Financial Services: $0.295 B

Geographic Concentration for Series B Startup Funding (Top 5 States)

-

By Deal Count: California (48), New York (17), Massachusetts (12), Washington (6), Michigan (5)

-

By Capital Deployed: California ($17.873 B), New York ($0.811 B), Massachusetts ($0.547 B), Washington ($0.343 B), Texas ($0.2915 B)

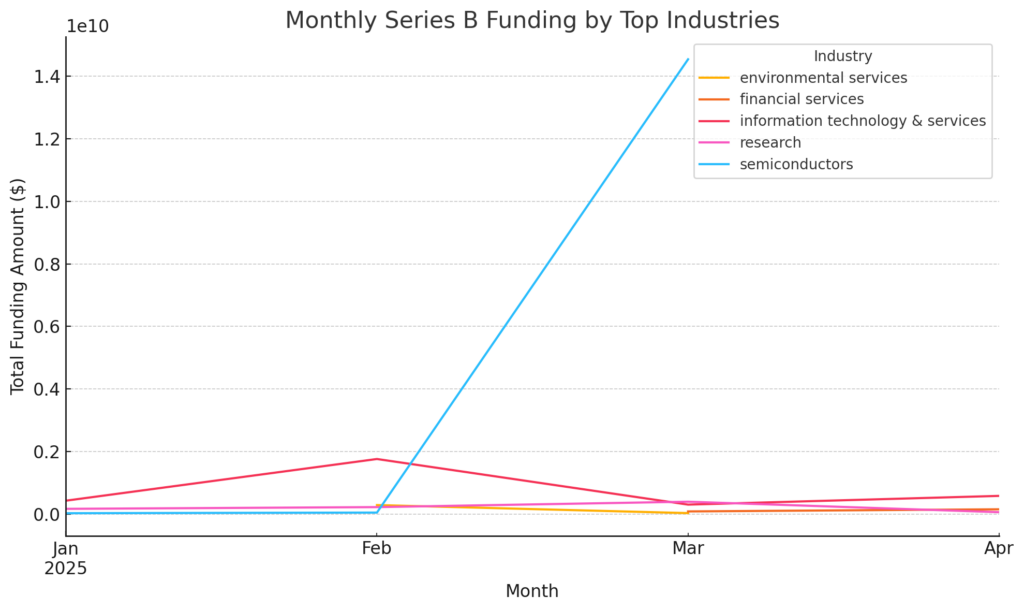

Series B Funding: Growth Curves Across Top Industries Compared

The growth curves for the top five Series B industries illustrate:

-

Semiconductors (blue line) dominate with a massive $14.614 B in March, showing a single blockbuster mid-quarter peak.

-

Information Technology and Services (red line) climbs from $50 M in January to $180 M in February, then dips and slightly recovers by April.

-

Research (pink line) remains steady around $20-30 M each month, peaking modestly in March.

-

Financial Services (orange line) shows a gradual rise from $15 M to $60 M over the period.

-

Environmental Services (gold line) exhibits low activity, with sporadic small raises around $10-30 M.

Key Takeaways:

-

Tidal Waves vs. Ripples: Semiconductors represent tidal-wave capital, whereas Research and Financial Services are more like steady ripples.

-

Timing Semiconductor Bets: Mid-quarter (March) is crucial for capturing semiconductor Series B funding .

-

Steady Plays: Research and Financial Services deliver consistent, lower-volatility funding, ideal for predictable deal flow.

-

Niche Signals: Environmental Services requires opportunistic sourcing given its low and sporadic activity.

Exceptionally Large and Small Series B Startup Funding Rounds

These outliers help pinpoint blockbuster mega-rounds alongside much smaller or undisclosed financings in Q1–Q2 2025.

Exceptionally Large Series B Rounds (> $131.9 M)

-

Mitra Chem (Semiconductors): $14.5 B on 2025-03-20

-

MODE (Information Technology & Services): $800 M on 2025-02-12

-

Together (Information Technology & Services): $305 M on 2025-02-20

-

Base Power (Electrical/Electronic Manufacturing): $200 M on 2025-04-09

-

Chestnut Carbon (Environmental Services): $160 M on 2025-02-12

Exceptionally Small Series B Rounds (≤ $12.75 M)

-

Big Bold Health (Health, Wellness & Fitness): $2.999983 M on 2025-01-16

-

iVeena (Pharmaceuticals): $3 M on 2025-02-05

-

Noble Gas Systems (Mechanical/Industrial Engineering): $4.2 M on 2025-03-19

-

Ria Health (Medical Practice): $6.5 M on 2025-03-06

-

Hypori (Computer & Network Security): $12 M on 2025-01-28

Strategic Targeting in Series B Startup Funding Rounds

Average Series B Funding Deal Size by Industry

-

Semiconductors: $3.65 B average (driven by mega-rounds)

-

Electrical/Electronic Manufacturing: $200 M

-

Defense & Space: $110 M

-

Research: $83.5 M

-

Entertainment: $80 M

Average Series B Startups Funding Deal Size by Geography

-

California: $372.4 M (largest hub for both volume and value)

-

North Carolina: $80 M

-

Texas: $72.9 M

-

Pennsylvania: $67.5 M

-

British Columbia: $66.3 M

Industry–State Clusters for Series B Funding Targeting

-

Semiconductors

-

California: 2 rounds @ $7.26 B avg

-

Michigan: 1 round @ $44 M

-

Washington: 1 round @ $45 M

-

-

Information Technology and Services

-

California: 25 rounds @ $90.5 M avg

-

New York: 13 rounds @ $42.9 M avg

-

Massachusetts: 2 rounds @ $34 M avg

-

-

Research

-

Massachusetts: 5 rounds @ $59.9 M avg

-

California: 2 rounds @ $109 M avg

-

Washington: 2 rounds @ $125 M avg

-

-

Environmental Services

-

California: 2 rounds @ $23 M avg

-

Colorado: 1 round @ $82 M

-

New York: 1 round @ $160 M

-

-

Financial Services

-

California: 2 rounds @ $78.5 M avg

-

Tennessee: 1 round @ $75 M

-

Georgia: 1 round @ $63 M

-

Strategic Takeaways:

Blockbuster vs. Boutique: Semiconductors in California demand enormous checks, ideal for major capital allocators, whereas sectors like Environmental Services and Financial Services offer mid-size but still substantial deals.

Volume Hubs: California is the go-to for deal flow across multiple industries; New York and Massachusetts are strong secondary markets, particularly for IT Services and Research.

Niche Opportunities: Colorado and Georgia show single high-value Environmental and Financial rounds, respectively, worth a closer look for differentiated bets.