List of Funded Seed Stage Startups (2025)

Seed-Stage Startups Are Building Fast and They’re Buying, Hiring, and Partnering Even Faster.

Fresh off their first major funding rounds, Seed startups are in high gear: hiring early team members, launching products, setting up key systems, and locking in the tools, partners, and people they’ll grow with.

At Fundraise Insider, we track newly funded Seed startups across the US and deliver direct access to their founders and key decision-makers so you can build relationships early, when they matter most – the best sales prospecting leads.

List of Funded Seed Stage Startups

👉 Get weekly leads from newly funded Seed startups

Weekly leads list includes: First Name, Last Name, Title, Company, Email, Linkedin Url, # Employees, Industry, Website, Company Linkedin Url, Facebook Url, Twitter Url, Company Phone, Technologies, Annual Revenue, Short Description, Founded Year, Top 5 Investors, Funding Amount, Headquarters, Funding Type, Funding Date.

Other Recently Funded Startups Data

- Pre-Seed startups

- Series A startups

- Series B startups

- Series C startups

- Series D startups

- Series E startups

- Series F startups

- Series G startups

- Recently funded startups across all funding stages

- AI startups

FAQs: Selling to Seed Stage Startups

1. Why should I sell to Seed stage startups?

Seed stage startups have just raised their first institutional round and are actively building their product, team, and go to market strategy. They are moving fast, making vendor decisions, and often rely on external partners to deliver key outcomes while they stay lean internally.

2. What makes Seed stage startups different from later stage companies?

Seed startups are in early stages of growth. They typically have small teams, are testing product market fit, and are looking to build scalable systems without hiring large teams. They prioritize speed, flexibility, and partners who can deliver real value quickly.

3. How can I find recently funded Seed stage startups?

Subscribe to Fundraise Insider to get weekly updates with contact details for Seed stage startups that have recently raised funding. These lists include company names, funding round data, and verified emails for decision makers.

4. Who should I contact inside Seed stage companies?

In most Seed stage startups, founders are still making all key buying decisions. Best contacts include:

- CEO or Co-Founder

- CTO or Head of Product

- COO or Strategy Lead

5. What are Seed startups focused on after raising funding?

After securing Seed capital, startups usually focus on:

- Building and launching their minimum viable product

- Acquiring early users or customers

- Collecting feedback and iterating on product features

- Hiring their first few key team members

- Establishing a brand and digital presence

6. What types of vendors do Seed stage startups usually hire?

Seed stage companies often hire vendors to fill execution gaps. This includes:

- Freelance developers or product design agencies

- Marketing consultants for brand and positioning

- Growth hackers or advertising partners

- Foundational tools for customer support and analytics

- Recruiters for engineering or early leadership roles

7. When is the best time to contact Seed startups?

The best time is within 1-2 weeks after their funding announcement. This is when founders are planning the next 3-6 months and are actively evaluating services and tools that can help them move faster.

8. What should I keep in mind when selling to Seed stage companies?

These companies have limited time and limited budgets. Keep your pitch short, clear, and results driven. Focus on how you reduce their risk, save them time, or help them reach their next milestone without requiring a big internal team.

9. How should I pitch my services to a Seed startup?

Focus on value and speed. Founders want vendors who act like partners. Avoid long presentations. Offer something helpful immediately like a teardown, insight, or relevant case study.

Example: “Congrats on your $2 million round. We helped another Seed stage startup in your space improve onboarding in 30 days. I put together 3 actionable ideas after looking at your demo. Would you like to see them?”

10. Can I get notified when Seed startups raise funding?

Yes. Fundraise Insider sends weekly updates with lists of Seed stage startups that just raised capital, including contact information so you can reach out with perfect timing.

Seed Stage Startups Funding Statistics and Trends

Total Seed Stage Startups Funded: 272 rounds between January 6, 2025 and April 17, 2025.

-

Average Seed funding: $6.68 million

-

Median Seed stage funding: $4.18 million

-

Interquartile range: $2.5 million (25th percentile) to $7 million (75th percentile)

-

Minimum: $0 (33 rounds)

-

Maximum: $200 million

Monthly Seed Stage Funding Trends:

-

Jan 2025: 65 rounds, $362.5 million total

-

Feb 2025: 95 rounds, $552.0 million total

-

Mar 2025: 74 rounds, $610.75 million total

-

Apr 2025 (through 4/17): 38 rounds, $292.5 million total

Top Industries by Seed Funding Round Count:

-

Information Technology & Services: 146 rounds

-

Financial Services: 16

-

Research: 15

-

Hospital & Health Care: 12

-

Computer & Network Security: 11

Top Industries by Total Seed Funding:

-

Information Technology & Services: $675.61 million

-

Research: $297.05 million

-

Computer & Network Security: $152.90 million

-

Financial Services: $112.50 million

-

Aviation & Aerospace: $82.80 million

Geographic Concentration of Seed Funding (Top 5 States):

-

California: 105 rounds, $762.26 million

-

New York: 49 rounds, $228.10 million

-

Massachusetts: 11 rounds, $272.30 million

-

Delaware: 8 rounds, $60.20 million

-

Washington: 8 rounds, $53.90 million

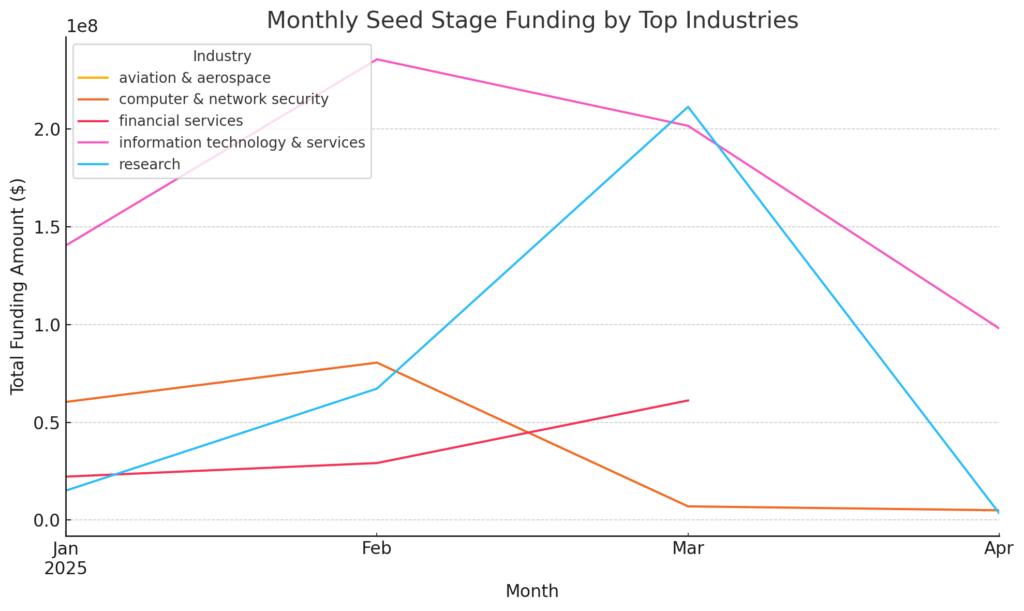

Seed Stage Startups: Growth Curves Across Top Industries

The chart above shows how monthly seed-stage funding has trended for the top five industries by total funding:

-

Information Technology & Services saw a strong uptick from $140 M in January to a peak of $235 M in February before tapering to $98 M in April.

-

Research climbed steadily through March—peaking at $210 M—then dropped off sharply in April.

-

Financial Services exhibited gradual growth, rising from $24 M in January to $62 M by March.

-

Computer & Network Security peaked at $81 M in February, then fell to under $5 M by April.

-

Aviation & Aerospace had more moderate but consistent funding, increasing January to February before declining thereafter.

This comparison highlights which sectors are gaining momentum in seed funding and which are experiencing pullbacks as the quarter progresses.

Average Seed Stage Funding Deal Size by Industry

-

Aviation & Aerospace leads with an average seed deal of $41.4 M.

-

Security & Investigations follows at $35.0 M per round.

-

Computer Hardware ($23.5 M) and Research ($19.8 M) also see above-market ticket sizes.

-

By contrast, Information Technology & Services averages just $4.6 M despite being the largest segment by count.

High-Volume vs. High-Value Sectors

-

Volume Play: Information Technology & Services accounts for 146 of 272 rounds (54%) but with moderate $4.6 M average checks.

-

Value Play: Niche areas like Aviation & Aerospace and Security & Investigations deliver fewer deals but much larger tickets—ideal for investors seeking fewer, higher-impact bets.

Geographic Hotspots for Deal Size

-

Massachusetts tops the state leaderboard with an average seed deal of $24.8 M across 11 rounds—despite lower volume.

-

California leads in volume (105 rounds) with a solid $7.3 M average deal size, making it a hybrid play for both volume and value.

-

New York (49 rounds) averages $4.7 M, closely mirroring the national IT & Services average.

Industry–State Clusters for Targeting

-

IT & Services:

-

California: 63 rounds, $5.15 M avg.

-

New York: 33 rounds, $4.94 M avg.

-

Washington: 6 rounds, $6.37 M avg.

-

-

Research:

-

California: 7 rounds, $7.93 M avg.

-

Pennsylvania: 2 rounds, $5.03 M avg.

-

(Also strong in British Columbia: 2 rounds, $8.75 M avg.)

-

-

Computer & Network Security:

-

California: 2 rounds, $10 M avg.

-

New York: 2 rounds, $7.5 M avg.

-

Texas: 2 rounds, $6.85 M avg.

-

-

Financial Services:

-

California: 6 rounds, $9.03 M avg.

-

New York: 4 rounds, $4.05 M avg.

-

Florida: 1 large round, $20 M.

-

-

Aviation & Aerospace:

-

California: 1 blockbuster round, $76.5 M.

-

Strategic Takeaways

-

For High-Value Returns: Focus on Aviation & Aerospace and Security startups in California and Massachusetts.

-

For Deal Flow: Target IT & Services ecosystems in California and New York.

-

Emerging Pockets: Pennsylvania and Washington show above-average research deal sizes.

-

Occasional Outliers: Keep an eye on Florida for standalone large financial-services rounds.

Exceptionally Large and Small Seed Funding Rounds

These outliers highlight where seed-stage capital has both concentrated in a few blockbuster bets and where extremely small checks have been written.

Top 5 Exceptionally Large Seed Rounds:

-

Lila Sciences (Research): $200 M on March 10, 2025; headquartered in Cambridge, Massachusetts.

-

Amca (Aviation & Aerospace): $76.5 M on April 8, 2025; El Segundo, California.

-

7AI (Computer & Network Security): $36 M on February 5, 2025; Boston, Massachusetts.

-

Orchid Security (Computer & Network Security): $36 M on January 14, 2025; New Castle, Delaware.

-

Spintly (Security & Investigations): $35 M on January 6, 2025; Milpitas, California.

Top 5 Exceptionally Small Seed Rounds:

-

Xogos Gaming (Computer Games): $20 K on January 8, 2025; Liberty, Missouri.

-

Arbol (IT & Services): $250 K on January 7, 2025; Buffalo, New York.

-

Irazu Oncology (Research): $500 K on March 5, 2025; Baltimore, Maryland.

-

Relm AI (IT & Services): $500 K on March 31, 2025; New York, New York.

-

Wonder Family (IT & Services): $500 K on March 11, 2025; San Francisco, California.